Tax Deductions for On-Demand Drivers

On-demand drivers for ridesharing companies, such as Uber or Lyft, are not employees and are instead considered independent contractors for tax purposes. Being an independent contractor means you are self-employed. This means that the company is not withholding any taxes from your pay and you will be responsible for paying your own federal income tax (and state income tax, if applicable), and Social Security and Medicare (FICA) taxes (self-employment tax) on your net profit as well as 100% of any associated costs.

On-demand drivers for ridesharing companies, such as Uber or Lyft, are not employees and are instead considered independent contractors for tax purposes. Being an independent contractor means you are self-employed. This means that the company is not withholding any taxes from your pay and you will be responsible for paying your own federal income tax (and state income tax, if applicable), and Social Security and Medicare (FICA) taxes (self-employment tax) on your net profit as well as 100% of any associated costs.

Tax Forms

Schedule C (Form 1040). You report all of your income and expenses associated with your business on Schedule C (Form 1040), Profit or Loss From Business, to determine your net profit (or loss). If you have a net profit of $400 or more, you must pay self-employment tax, which is computed on Schedule SE, Self-Employment Tax.

Form 1099-NEC. On-demand drivers may receive Form 1099-NEC if they have earned referrals, incentives, or bonuses from a ridesharing company. If you earned less than

$600, the company may not issue you a Form 1099-NEC, Nonemployee Compensation, instead, you must identify (log into your account online, for example) the total amount you earned as this income must be reported in your gross profits along with your fares. The rideshare company should still provide this total to you even if it does not provide an actual tax form.

Form 1099-K. On-demand drivers who get their fares through a ridesharing company will generally receive Form 1099-K, Payment Card and Third Party Network Transactions, which reports the number of fares/fees received by the rideshare company on your behalf. Amounts received are broken down by month, and the form also shows the total annual amount.

Car Expenses

Car Expenses

You can deduct car expenses associated with your on-demand driving business. You generally can use either the standard mileage rate or your actual car expenses to compute your deductible car expenses. If you qualify to use both methods, you may want to compute your deduction both ways to see which gives you a larger deduction. Regardless of which method you use, you should note your odometer reading at the beginning and end of the year and all business-related mileage. Ridesharing companies generally only keep track of the mileage for your actual fares, not the additional miles you may spend driving around waiting to pick up fares and driving to and from fares.

Standard mileage rate. The business standard mileage rate for 2021 is 56.0¢. If you use the standard mileage rate for a year, you only need to keep track of your mileage, so there is a lot less information to record. However, you can- not deduct your actual car expenses such as depreciation, lease payments, maintenance and repairs, gasoline (including gasoline taxes), oil, insurance, or vehicle registration fees in addition to claiming the standard mileage rate.

When using the standard mileage rate, you can also deduct car loan interest, personal property taxes, and business-related parking fees and tolls.

Actual car expenses. It is a good idea to keep track of all of your actual expenses for the year to compare to the standard mileage rate to determine which deduction is greater. Some actual car expenses include:

Depreciation Licenses Gas Oil

Car washes Lease payments Insurance

Garage rent Parking Air fresheners Registration fees

Repairs Tires Tolls Cleaning supplies

If you use your car for both business and personal purposes, you must divide your expenses between business and personal use. You can divide your expenses based on the miles driven for each purpose.

In order to take actual expenses, you need to keep track of all expenses related to your car and related receipts.

Other Business Deductions

In addition to car expenses, you may incur some other common operating expenses you can deduct to offset your income. You can deduct an expense if it is both ordinary and necessary. An ordinary expense is common and accepted in your particular line of work. A necessary expense is helpful and appropriate for work. An expense need not be required to be considered necessary. Even though an expense may be ordinary and necessary, the cost may not be deductible.

In addition to car expenses, you may incur some other common operating expenses you can deduct to offset your income. You can deduct an expense if it is both ordinary and necessary. An ordinary expense is common and accepted in your particular line of work. A necessary expense is helpful and appropriate for work. An expense need not be required to be considered necessary. Even though an expense may be ordinary and necessary, the cost may not be deductible.

- Office expenses. If you keep a logbook of your work, the amounts you spend for a notepad, pen, paper, could be a deductible business expense.

- Legal and professional services. The amount you pay for legal or professional help (including tax preparation) could be a deductible business

- If you provide refreshments exclusively available to your riders, such as gum, snacks, or a cool- er full of bottled water or soda, the amount you spend on those items can be deducted as a meals expense.

- Business meals are subject to a 50% limitation. Exception: For 2021, business meals provided by a restaurant are fully deductible (100%).

- Cell As an on-demand driver, you generally receive fares through an app on your cell phone. If you use your cell phone for personal and business use, the cost of your cell phone and service should be prorated. If you use a second cell phone exclusively for your business, then 100% of its cost and service may be deductible.

- Service Most ridesharing companies charge a service fee for each fare. Service fees are generally taken out of the total fare price and the driver receives the remainder amount. You can deduct the number of service fees you paid during the year.

- Interest on a car loan. If you own your car (not leased) you can deduct the part of your car loan interest that represents your business use of the car. You cannot deduct the part of the interest expense that represents your personal use of the

- Personal Property Taxes. You can deduct the business percentage of state and local personal property taxes paid for your vehicle. The personal portion of personal property taxes is deductible if you

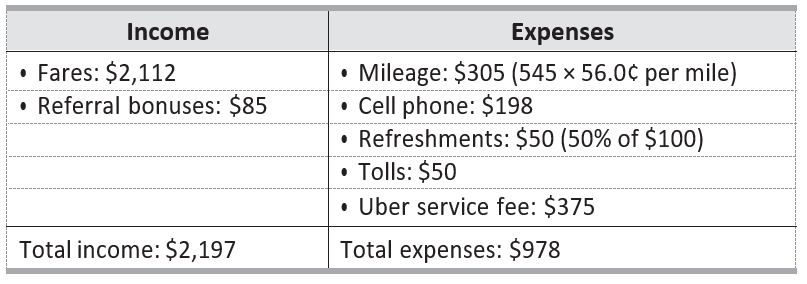

Example: Holly is a part-time driver for Uber who uses the standard mileage rate. In 2021, her total fare trip mileage is 420 miles, but she actually drives 545 total miles related to her business. She pays $50 in tolls while driving. The business percentage of her annual cell phone expense is $198. Holly provides refreshments (bottled water, soda, snacks) to her riders for a total cost of $100. She receives Form 1099-K, which shows her total income (fares/ fees) as $2,112. She also receives $85 in referral bonuses from Uber and pays Uber service fees totaling $375.

Holly’s net profits are $1,219 ($2,197 – $978). Assuming she is in the 10% federal tax bracket and 4% state tax bracket, her total taxes for her part-time driving business are listed below.

Federal income tax.................................... $122

State income tax......................................... $49

Self-employment tax.................................. $172

Total taxes................................................... $343

Contact Us

Contact Us

There are many events that occur during the year that can affect your tax situation. Preparation of your tax return involves summarizing transactions and events that occurred during the prior year. In most situations, treatment is firmly established at the time the transaction occurs. However, negative tax effects can be avoided by proper planning. Please contact us in advance if you have questions about the tax effects of a transaction or event, including the following:

- Pension or IRA

- Significant change in income or deductions.

- Notice from IRS or other revenue

- Job

- Divorce or

- Marriage

- Self-employment.

- Attainment of age 59½ or 72.

- Charitable contributions of property in excess of $5,000.

- Sale or purchase of a

- Sale or purchase of a residence or other real