Taxes 2022: Education Tax Benefits

You can claim more than one education benefit in a tax year as long as you do not use the same expenses for more than one benefit.

You can claim more than one education benefit in a tax year as long as you do not use the same expenses for more than one benefit.

Exception: Qualified expenses used to claim education benefits can also be used to eliminate the 10% penalty on premature IRA distributions.

For each student, you can elect for any year only one of the following benefits. For example, if you elect to claim the American Opportunity Credit for the student in 2021, you cannot use that same student’s qualified education expenses to compute the Lifetime Learning Credit or tuition and fees deduction.

Education Deductions

Deductions reduce the amount of income subject to income tax. Deductions for education expenses include:

- Student loan interest deduction up to $2,500 from gross income. Income limitations apply.

- Business deduction on Schedule C or F. You may be able to deduct the cost of education related to the business or farm activity.

Education Tax Credits

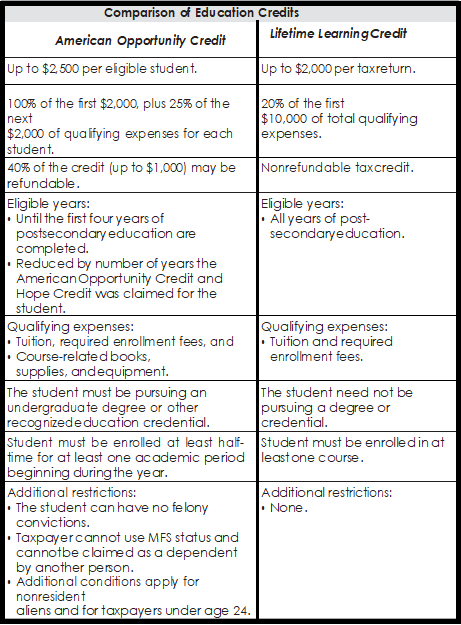

Tax credits reduce the amount of income tax you may have to pay. Income limitations apply. The education credits are claimed on Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits).

- American Opportunity Credit, $2,500 maximum per student per year.

- Lifetime Learning Credit, $2,000 maximum per tax return per year.

Income Limits

The American Opportunity Credit is phased out at modified AGI between $80,000 and $90,000 ($160,000 and

$180,000 MFJ) in 2021.

The Lifetime Learning Credit is phased out at modified AGI between $80,000 and $90,000 ($160,000 and $180,000 MFJ) in 2021.

Penalty-Free IRA Distributions

If you withdraw money from your IRA before you are age 59½, you are generally subject to a penalty of 10% of the distribution, in addition to any tax that may be due on the distribution.

- The 10% penalty does not apply to traditional IRA or Roth IRA withdrawals, if you use the money to pay qualified education expenses for yourself, your spouse, or for any child or grandchild of yourself or your spouse.

- Qualified education expenses include tuition, fees, books, supplies, equipment, and special needs services required for enrollment or attendance at an eligible educational institution. Room and board for students enrolled at least half-time in a degree or certificate program may also qualify.

- Reduce qualified expenses by scholarships and other tax-free assistance the student receives, but not by gifts or inheritances.

Education Savings Plans

Education Savings Plans

Contributions that you make to education savings plans are not federally tax-deductible, but the earnings accumulate tax-free. In addition, no tax will be owed on distributions if they are less than the beneficiary’s qualified education expenses. Qualified expenses are reduced by scholarships, other tax-free assistance, and amounts used to figure education credits.

- Qualified Tuition Programs (QTPs). States sponsor QTPs to allow prepayment of a student’s qualified high- er education expenses. For information on a specific QTP, you need to contact the state agency or eligible educational institution that established and maintains it. You may not distribute more than $10,000 in expenses for tuition during the taxable year for public, private, or religious elementary or secondary school from a 529 Plan. Distributions over $10,000 are subject to tax. This limitation applies on a per-student basis, rather than a per-account basis.

Note: QTPs are also called 529 Plans because they are authorized under section 529 of the Internal Revenue Code.

- Coverdell Education Savings Accounts (ESAs). A Coverdell ESA can be used to pay a student’s eligible K-12 expenses, as well as higher education expenses. Coverdell ESA contributions are limited to $2,000 total per year for each beneficiary, no matter how many accounts have been established or how many people are contributing. Unless the beneficiary is a person with special needs, contributions to a Coverdell ESA must stop before the beneficiary reaches age 18 and the account balance must be distributed within 30 days after the beneficiary reaches age 30 (or dies, if earlier).

Exclusions From Gross Income.

Exclusions From Gross Income.

An exclusion from income means you do not report the benefit you receive as income and you do not pay tax on it, but you also cannot use that same tax-free benefit for a deduction or credit.

- You may exclude the part of scholarships, fellowships, and grants that you use for qualifying education expenses while you are a degree candidate.

- You may exclude up to $5,250 paid for you under a qualifying educational assistance plan. Additional amounts are included in your W-2 income unless they are a working condition fringe benefit. This includes the principal or interest of any qualified education loan of the employee.

- If you cash in qualified U.S. Savings Bonds to pay for eligible education expenses for yourself, your spouse, or your dependent, you may exclude the bond interest from your income. Income limitations apply.

Why We Appreciate Referrals

We acquire many of our customers through referrals from satisfied clients. Beyond the benefit of being able to expand our business, there are other reasons why we appreciate referrals. When a client thinks enough of us to recommend our services to a family member, friend, or co-worker, we attain a higher quality clientele than those we acquire from more random marketing efforts. A personal recommendation can help jump-start the business relationship, resulting in a more efficient, effective tax engagement.

Please consider sharing this brochure with any individual who you believe might find our services useful.

Benefits of Using a Paid Preparer

Benefits of Using a Paid Preparer

With so many do-it-yourself tax programs available for sale, it is a legitimate question to ask why you should hire a paid preparer when you can create and file a tax return on a home computer.

Keep in mind that entering tax information into a computer program and making adjustments necessary to clear the program’s diagnostic error messages is no substitute for understanding tax law. The Internal Revenue Code and related Treasury Regulations contain over 10,000 pages of complicated provisions. Working with a tax professional who understands how the provisions affect your specific situation and how the rules interact can provide you with the best result on your tax return. Obtaining tax benefits is often a complex process involving properly executed and timely-filed elections. Simply entering amounts into an in- put program may lead to lost benefits. We find that in many cases we save new clients more than the cost of our services compared to returns they have prepared themselves.

Proper reporting and filing can also help keep you off the IRS radar.

Other Benefits Include:

- When your information is compiled and we’ve examined and discussed your unique tax situation, we take care of preparing the forms and file the returns electronically.

- We will explain details of how items of income and expense affect your return and will make recommendations on how to reduce your tax liability.

- If you receive any communication from the IRS or state revenue department, we are available to assist you with resolution.

- As professional tax preparers, we know the proper means of reporting income and deductions, the proper forms to use, and the proper entries to make. Using a paid preparer makes your return much more likely to be “accepted as filed,” meaning in most cases you will avoid the dreaded letter from the IRS triggered by a box that was not checked or a number entered on the wrong line.

- We can discuss with you the tax effects of any changes in income anticipated for the coming year, to help eliminate the guesswork involved with figuring out what your tax situation will be in future years.

- We can make recommendations for changing withholding at work to help put you in the position you want to be in when it comes time to file next year’s return.

Tax Issues

Our clients frequently contact us for assistance in dealing with tax issues such as the following.

- Pension or IRA distributions.

- A significant change in income or deductions.

- Job change.

- Start-up or sale of a business.

- Purchase or sale of a home or other real estate.

- Divorce or separation.

- Self-employment or contract work.

- Large charitable contributions.

- Children in college.

Confidentiality

As professional tax preparers, we are bound by rules of ethics to keep all of your information confidential. We take great care in handling your information, including names, addresses, birth dates, Social Security Numbers, and items of income and deductions. We have safeguards in place to protect the security of your physical documents as well as the security of electronic information used to process and file your returns with the IRS and state revenue agencies.

We adhere to strict rules regarding any disclosure or use of your personal information. We will not disclose or use any of your personal information obtained during the tax engagement for purposes other than the preparation and filing of your returns unless we obtain specific written authorization from you in advance.

Checklist of Common Errors When Preparing Your Tax Return

The IRS created the following checklist based on common filing errors.

- Did you choose the correct filing status?

- Did you enter the names and Social Security Numbers for everyone listed on your return exactly as those names and numbers appear on each person’s Social Security card? If there have been any name changes, be sure to contact the Social Security Administration at www.ssa. gov or call them at 800-772-1213.

- Did you enter your income on the correct lines?

- Did you calculate deductions and credits correctly, put them on the right lines, and attach the necessary forms or schedules?

- Did you figure the tax correctly?

- Did you sign and date the return?

- If you filed a paper return, did you use the correct mailing address from your tax form instructions?

- If you are due a refund and requested a direct deposit, did you double-check your routing and account numbers for your financial institution?

- Did you make a copy of the signed return and all schedules for your records?

EMAIL: [email protected] WWW.IW-CPA.COM PHONE: 781-883-3174